Estate Planning

Look at the person to your left. Now look at the person to your right.

There is a very good chance that only one of you has created a will.

There’s also a very good chance that one of the people who doesn’t have a will is you.

The new thing here is that I’m not selling you anything. I’m only asking you to think about it, because it’s actually a financial help thing.

Thinking about not being here is a depressing thing. I get it.

The thing is, if you have an idea of how you want things to work out, then you should at least put together a simple will. Don’t have kids? Don’t think you have enough money to call it an estate? Doesn’t matter.

If you have things you want to make sure someone gets after you’re gone, or if there is an organization that you want to get a little money, then write the will. It helps make the afterwards a little easier for the folks who are still around.

It doesn’t have to be complicated. It doesn’t have to involve staying overnight in a haunted house and discovering that the ghost is just old pipes and the creepy caretaker. It can just be simple. Some states even have forms that you can do yourself when it’s really really simple.

But it needs to be done, people. It’s not fun, but it can be a relief to know you’ve got something set up. You can make changes if your life situation changes [and we all know it will].

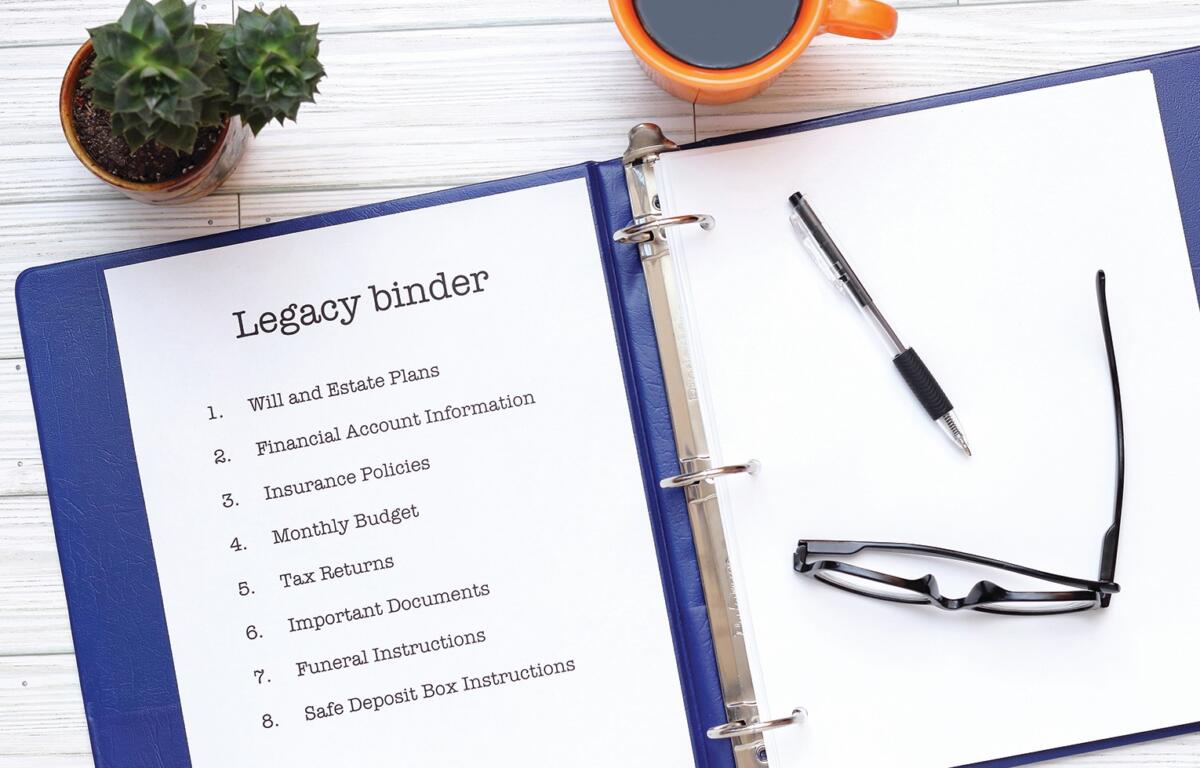

A part of this is having records somewhere that have information like where your accounts are. There was a recent article about folks who went to file for their pensions from a company that closed a while ago, and they couldn’t remember where they needed to go. Writing these things down and keeping them in a safe, secure place is pretty smart. [Of course, if you’re trying to be sneaky and put them in a safe deposit box no one knows you have, that defeats the purpose. Safe deposit box – good, secret location – bad, unless you share it with a trusted person.]

If you have children in the picture, then this is also where you get to set up protections for them. You can arrange who will care for them if the unthinkable happens and ask them to be raised a certain way.

Is all of this depressing? Yup.

But it can be reassuring, too. When you make plans that are just in case like this, it can peel away one layer of stress or concern.

It also should not impact your day-to-day budget dramatically. It’s a document that you can set up, and schedule times to check in on it, and update it. If you have a more complicated estate, then work with a professional. It can save headaches, it can save money for your beneficiaries, it can save you from some stress.

So go work on a will. Then maybe have a little ice cream or something, if budget allows, because you did a good thing, and a small [affordable!] treat might be called for.

As always,

Save on purpose, spend on purpose.

Article written by Franklin First’s resident Financial Coach, David Howe