By JULIE CUNNINGHAM

(Boston, MA) In a bid to support Main Street businesses, the Baker-Polito administration has filed legislation to create two tax free months in Massachusetts. If successful, the entire month of August and the entire month of September would be tax free in Massachusetts. The tax revenue for FY2021 is 14.9% higher than projected, according to the administration.

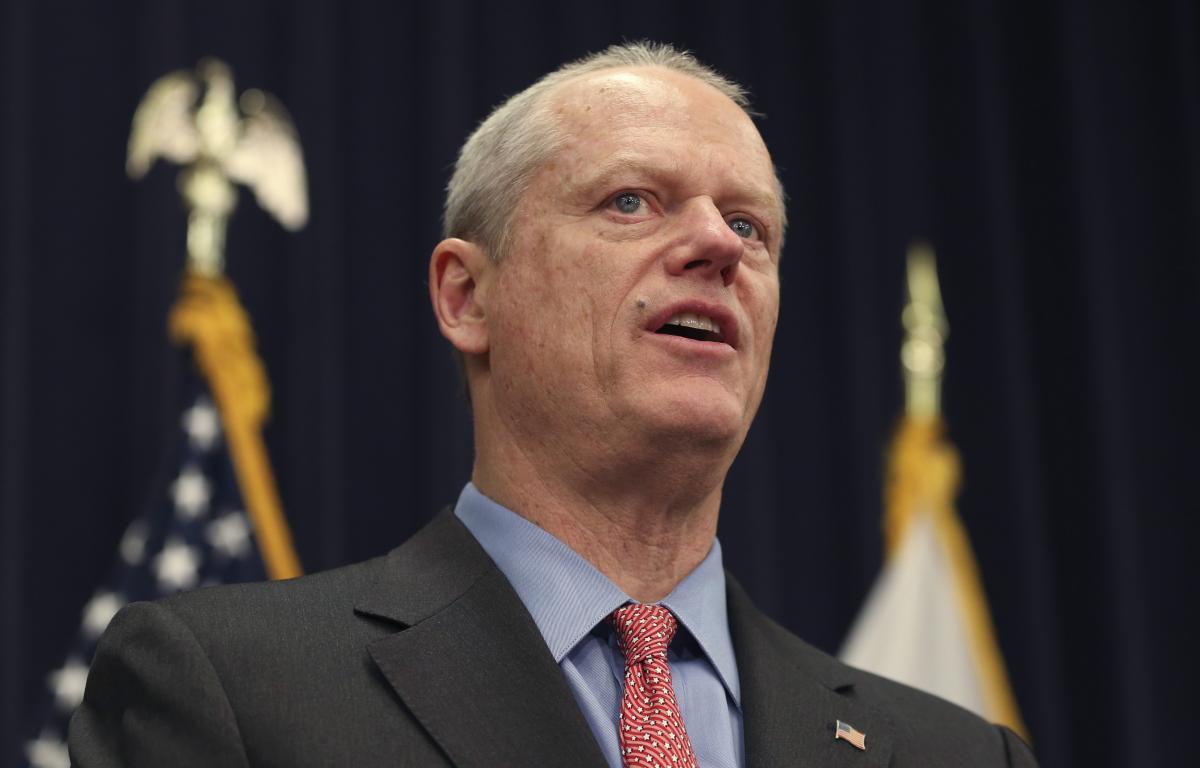

“A two-month sales tax holiday will provide a boost to Massachusetts’ taxpayers and Main Street economies as we continue to recover from COVID-19,” said Governor Charlie Baker. “Massachusetts’ economic recovery is off to a good start, but it’s crucial that the Commonwealth takes action now to spur more economic activity in communities and support taxpayers. Thanks to stronger than expected tax revenues, the Commonwealth has managed to grow the Rainy Day Fund to a balance higher than it was at the beginning of the pandemic, and we can also afford to return these tax dollars to our residents and small businesses.”

Federal funds received during the COVID-19 pandemic also provide relief and further resources to reduce pressure on the operating budget. Revenues through May 2021 are $3.93 billion higher than the bench mark to date. The official sales tax weekend in Massachusetts is August 14-15. This legislation would expand the tax free initiative to support businesses in the Commonwealth. The Stabilization Fund balance stands at $4.4 billion, quadruple the balance since 2015.

“We are proud to offer this proposal to keep money in the hands of taxpayers and promote economic development amidst Massachusetts’ recovery from the COVID-19 public health emergency,” said Secretary of Administration and Finance Michael J. Heffernan. “These two sales tax-free months would be a great opportunity for consumers throughout local neighborhoods to help support small and Main Street businesses and grow our economy.”